What You Need to Know About Prefab Metal Building Kits Prices in 2026

Outline: How This Guide Approaches Prefab Metal Building Pricing

Price questions often sound simple—“What does a steel building kit cost?”—but real answers depend on design choices, engineering, logistics, and timing. To make sense of 2026 pricing, this guide starts with a map. First, we define the major cost drivers inside a kit: the steel itself, structural design, coatings, doors and windows, and insulation. Then we stack external influences on top: freight, regional labor, energy, and local code requirements. Next, we translate those drivers into realistic per‑square‑foot ranges and size‑based examples. Finally, we look at market context for 2026 and the total cost of ownership so you can plan a complete budget rather than just the headline kit number.

Here’s how the story flows and what you can expect to take away:

– Factors Influencing Prefab Metal Building Kit Costs: a practical breakdown of design, materials, and specification choices that move the price needle, with examples that show why two similar‑sized buildings can be priced miles apart.

– Average Steel Building Kit Prices: kit‑only and erected ranges, common size examples, and how optional packages (insulation, doors, overhangs) step the total up in predictable increments.

– Market Dynamics and 2026 Outlook: how steel benchmarks, freight, weather, and regional nuances can push or pull quotes; tips for reading quotes and timing deposits without risky speculation.

– Smart Budgeting and Total Cost of Ownership: site prep, foundations, utilities, and maintenance considerations that belong in your spreadsheet from day one, plus a checklist for apples‑to‑apples quote comparisons.

Think of this guide as a field manual. It won’t sell you on a particular vendor or promise a magic number; instead, it explains how prices are built—piece by piece—so you can predict outcomes with greater confidence. By the end, you’ll understand why a clean 30×40 kit might be thousands less than a heavy 40×60 with higher snow loads, or why a bargain quote without engineered drawings can cost more after plan review. If you’re planning a shop, barn, warehouse, or hybrid space, the structure of your decisions—span, height, loads, finishes—will structure your costs. Let’s open the box thoughtfully.

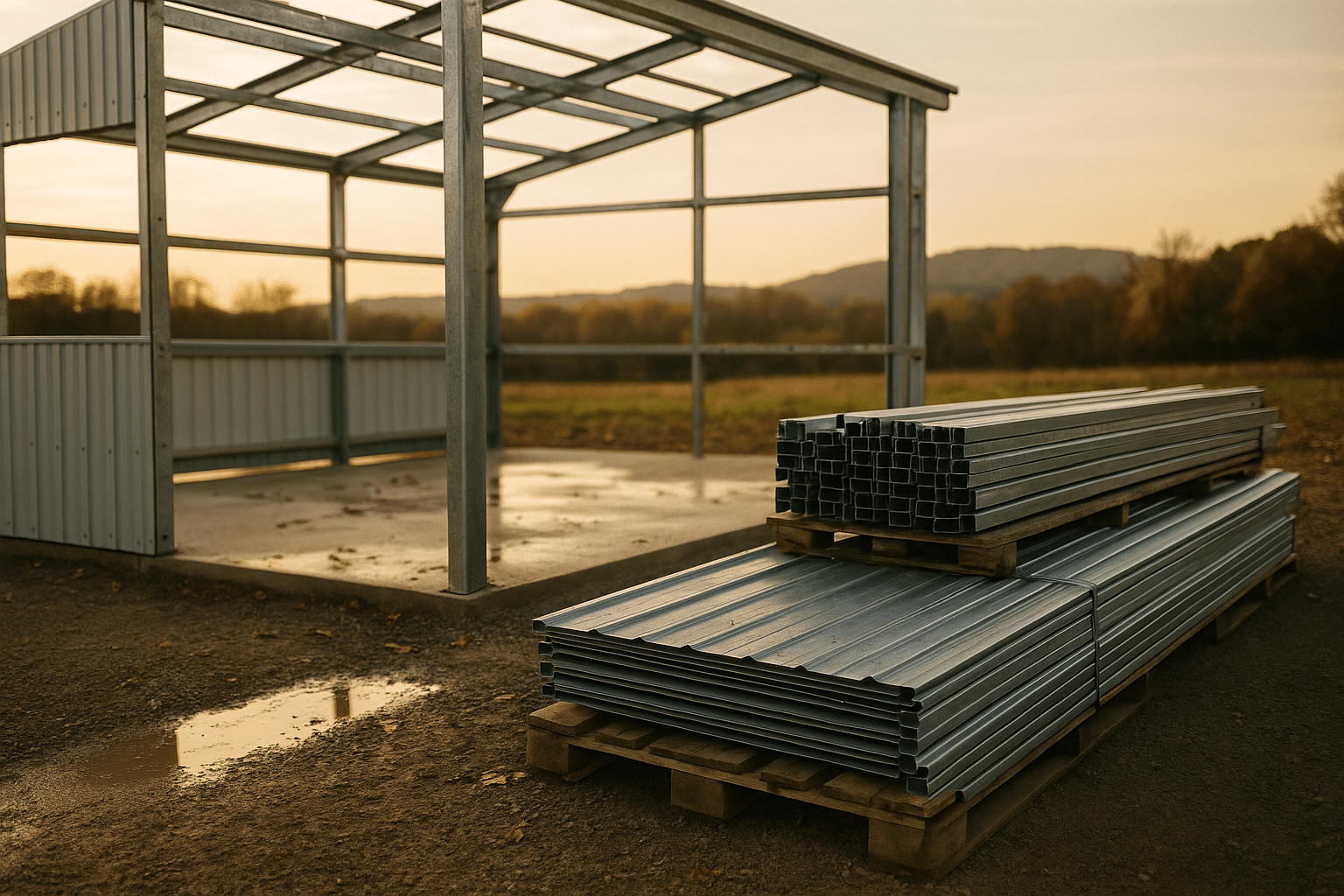

Factors Influencing Prefab Metal Building Kit Costs

Kit pricing starts with steel tonnage, and tonnage follows design. Wider clear spans, taller eave heights, and higher wind or snow ratings demand heavier members and additional bracing. Increasing a building from a 30‑foot to a 40‑foot span does more than add 33% to width; structural demands can escalate nonlinearly, especially in high‑load regions. Likewise, stepping from a 12‑foot to a 16‑foot eave height can change column sizes, connection hardware, and lateral bracing. Complexity costs money, even when the footprint looks similar on paper.

Specification choices also have predictable price effects:

– Framing system: rigid frame clear‑span is efficient for open interiors; multi‑span frames can reduce steel in larger footprints but add interior columns that some uses can’t accommodate.

– Roof pitch: low‑slope roofs use less material than steep pitches; however, snow country may require steeper angles or additional purlins.

– Secondary members: girt and purlin spacing, gauge, and profiles affect both strength and sheet metal usage.

– Cladding: thicker wall and roof panels with higher rib profiles improve performance and durability but increase cost; color‑coated finishes typically add a modest premium over bare or galvanized.

– Openings: each framed opening (roll‑up door, personnel door, window) adds framing, trim, and potentially heavier headers; many buyers underestimate how fast three large doors can add thousands to a quote.

– Insulation and envelopes: basic single‑layer fiberglass is inexpensive; higher R‑values, double‑layer systems, or insulated metal panels raise material and labor but can lower long‑term energy bills.

Beyond the bill of materials, logistics and administration matter. Freight is sensitive to distance, load size, and fuel costs; rural deliveries, tight sites, or special offloading needs can add surcharges. Engineering and permitting can be straightforward or intricate: sealed drawings for your jurisdiction, foundation reactions, and special inspections should be clarified up front. Quote validity windows—often 15–30 days in volatile markets—can shift totals if you wait too long to lock in. Regional differences also show up in base‑metal availability, local code amendments, and snow or wind exposure categories.

Two brief scenarios show how this unfolds. A 30×40×12 light‑duty shop in a mild climate with a low roof pitch and two small doors can be quoted with light frames, standard purlins, and basic insulation, leading to a lean kit. Change only the environment to coastal wind or mountain snow, and the same footprint might require heavier frames, tighter purlin spacing, upgraded fasteners, and deeper eave struts. The dimensions didn’t change, but the structural story did—so did the price.

Average Steel Building Kit Prices: 2026 Reference Ranges

Because every project is unique, any “average” needs context. Still, you can use reasonable 2026 reference ranges for planning. The kit price generally covers the engineered framing, roof and wall panels, trim, fasteners, drawings, and basic hardware. It usually excludes the concrete foundation, erection labor, mechanicals, and site work. Delivery is sometimes included and sometimes billed separately—clarify this in writing.

Typical planning ranges many buyers see:

– Kit‑only (delivered, simple enclosed buildings): roughly $9–$18 per sq ft for common spans and loads; complex designs, high loads, or premium finishes can run higher.

– Erected shell (kit plus labor, not including slab or utilities): commonly $18–$40 per sq ft depending on region, complexity, access, and schedule.

– Concrete slab (varies by thickness, rebar, soil conditions, and finish): often $4–$12 per sq ft, but local markets can push above these figures.

Size‑based illustrations help translate the ranges into ballpark numbers, assuming straightforward specs and average freight:

– 20×30 (600 sq ft) kit‑only: about $5,400–$10,800; erected shell: around $10,800–$24,000.

– 30×40 (1,200 sq ft) kit‑only: about $10,800–$21,600; erected shell: around $21,600–$48,000.

– 40×60 (2,400 sq ft) kit‑only: about $21,600–$52,800; erected shell: around $43,200–$96,000.

– 60×100 (6,000 sq ft) kit‑only: about $54,000–$108,000; erected shell: around $108,000–$240,000.

Add‑ons that often move totals more than buyers expect include:

– Insulation packages: basic liner systems may add a modest per‑square‑foot amount; higher R‑values and insulated panels add significantly more.

– Overhead and roll‑up doors: large, wind‑rated units carry notable premiums; factor framing, seals, and hardware.

– Architectural touches: canopies, parapets, roof extensions, or wainscot panels add material and labor.

– Coatings and color: color‑matched trim and high‑performance finishes are small upgrades individually but add up across big envelopes.

Why the wide ranges? Labor markets, access, and design complexity vary by job. A clear, open site with all‑weather access is faster to erect than a hillside with narrow gates. A simple box with one big door assembles quicker than a facade with numerous penetrations. The goal is to budget with room for options, then refine as drawings and quotes become specific. Treat the ranges as scaffolding for your plan—not a final invoice.

Market Dynamics in 2026: Steel, Logistics, and Regional Effects

The 2026 picture is shaped by three big levers: steel benchmarks, freight and logistics, and regional code environments. Steel is the heart of a metal building kit, and benchmark coil prices ripple through plate, shapes, and panels. Over the last few years, volatility has been notable, with periods of rapid increases followed by normalization as mills adjusted output and inventories rebalanced. For buyers, the takeaway is timing and quote management: a price that looks high today may moderate later, but waiting can also risk a bump if demand and input costs tighten again.

Freight and logistics form the second lever. Fuel costs, driver availability, and lane imbalances can make delivery a predictable line item or a moving target. Long hauls to remote sites, split shipments, or special equipment for offloading will add to the bill. Coordinating delivery with foundation readiness reduces on‑site storage costs and weather exposure; each re‑handling step introduces risk and potential damage claims. In 2026, plan for precise scheduling and an allowance for unexpected delays, especially in peak construction seasons.

Regional effects are the third lever and are sometimes overlooked. Local code adoption cycles can raise minimum wind or snow loads; seismic detailing can require heavier connections; coastal exposure categories may call for denser fastener patterns and stouter panels. Utilities, access roads, and environmental permitting vary by county and can either streamline or stretch timelines. The same 40×60 shop drawn for a mild inland zone could need materially different engineering when placed near a high‑wind coastline or at elevation in snow country.

Practical strategies for 2026 include:

– Lock quotes within validity windows and understand escalation clauses; many suppliers hold pricing for a set period once deposits are received.

– Ask for alternates: compare a 1:12 roof pitch versus 3:12, or R‑10 versus R‑19, so you can see cost deltas and decide what matters.

– Phase purchases: some buyers secure the primary frame first and add accessories later, though this requires careful coordination to avoid mismatches.

– Watch seasonality: ordering in late winter for spring delivery can balance mill lead times and site conditions in many regions.

In sum, the 2026 outlook is neither doom nor boom—it is a working market. Prices respond to inputs, and informed buyers respond with planning. Control what you can—scope clarity, schedule, and specs—and you’ll reduce exposure to what you can’t.

Smart Budgeting, Quotes, and Total Cost of Ownership

A strong budget sees beyond the kit and into the whole project. The kit is the core, but the shell stands only when site prep, foundation, utilities, and finishing details cooperate. A simple spreadsheet with clear categories helps you avoid unpleasant surprises and compare offers with confidence. Start by listing inclusions and exclusions, then give each line a range until you can replace it with a firm quote.

Common items to track beyond the kit:

– Site work: clearing, grading, compaction, drainage, and access improvements.

– Foundation: soil testing, engineering, formwork, slab thickness, vapor barriers, rebar, anchor bolts, and edge details.

– Erection labor: crew rates, equipment (lifts, cranes), safety gear, and mobilization costs.

– Utilities: trenching, conduit, water, septic, gas lines, and electrical service upgrades.

– Interior build‑out: partitions, mezzanines, HVAC, lighting, and finishes if your use requires them.

– Permits and professional services: plan review fees, inspections, geotechnical reports, and stamped drawings if your jurisdiction mandates them.

Quote hygiene matters. Ask each supplier to price the same scope: identical width, length, eave height, design loads, roof pitch, panel gauge, insulation levels, and opening sizes. If a quote appears lower, look for omissions rather than miracles. Are framed openings included or just cutouts? Are door packages complete with seals and hardware? Do drawings include reactions for your foundation engineer? A clean comparison turns confusion into leverage.

Assembly decisions also affect outcomes. Erecting with an experienced crew can reduce call‑backs and speed dry‑in; self‑performing with a small team can save money if schedules are flexible and safety is prioritized. Consider the risk‑reward trade: a slower schedule may be fine for a private shop but problematic for a revenue‑generating warehouse. Equipment rentals such as telehandlers, scissor lifts, or a small crane should be scheduled to match the sequence so you’re not paying for idle days.

Finally, think in years, not days. Insulation quality influences energy and condensation control; robust coatings and trims reduce maintenance; gutters and downspouts protect the slab edge and landscaping. A slightly higher upfront spend on the envelope can return value over decades through lower operating costs and better durability. In other words, buy for the work your building must do, not just the week you sign the check.